Contact Us

Contact Us

Or Get In Touch with Us below

Mailing Address

2112 Broadway St NE,

Ste 225 #280

Minneapolis, MN 55413

Our System Is Trusted By Many Small Business Owners

Don't Just Take Our Word For It. Here Are Some Comments From Our Clients

Platform Frequently Asked Questions

CAN I CANCEL AT ANY TIME?

Yes, can cancel any time. Try our platform free for 14 days. Once your sign up, we’ll provide you with a free, personalized onboarding to get you up and running as soon as possible.

WHAT OTHER FEES CAN I EXPECT?

There are no additional recurring fees. There may be charges beyond standard monthly free credit for things like texts, emails & calls etc. which are billed directly through Twilio & Mailgun. Pricing subject to change. $0.002/email, $0.047/min for making calls, $0.0255/min for receiving calls, $0.0237/text. SMS Texts send to outside US/Canada subject to additional $0.0079 per text

WHAT TYPE OF SUPPORT & HELP CAN I EXPECT?

We offer extensive online ticketing support from our team or you can use our live support during office hours including live chat on our website. We also offer live training sessions, and a video library of NationwideLeads produced how-to videos.

WHY DO I NEED ONBOARDING?

Onboarding is primarily to get you setup, perform any migrations and provide needed training and coaching. To ensure that all of our Nationwide Leads users are setup properly in the tool and in compliance, we provide free onboarding services which could take as little as 20 minutes

DO I HAVE TO PAY FOR ANY NEW FEATURES?

Nope, you’re grandfathered in! We update our app very frequently, so you get to enjoy some of the industry’s leading new features as a Nationwide Leads user!

Nationwide Leads Work Great With:

& More...

Insurance Agents

Attorneys

Chiropractic

Fitness Centers

Tax Services

Counseling

Med spa

Mortgage Officer

Personal Coach

IT Services

Accountants

HR Services

Breweries

Mechanics

Plumbers

Cleaning Services

Trees & Landscape

More...

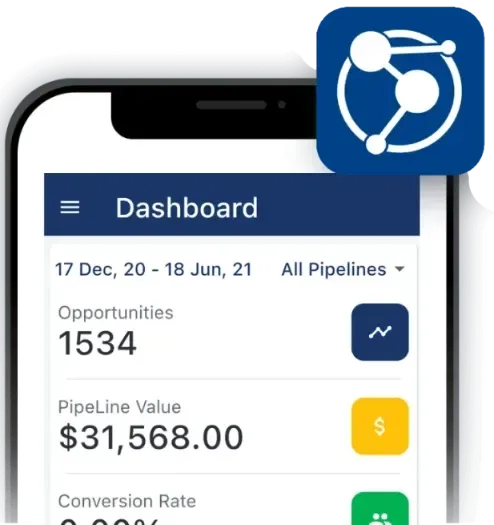

Bring NationwideLeads on the go with our Lead Connector App

Receive all of your inbound calls with our iOS & Playstore Mobile App. Assign specific phone numbers to staff members and track calls. Text on the go to all your lead inquiries. The time-saving opportunities are endless.

Email, Video SMS, Calls, etc

Drop Ringless Voicemails

Track All Leads & Calls

Custom Business Number

2026 | All Rights Reserved

2112 Broadway St NE, Ste 225 #280, Minneapolis, MN 55413

2112 Broadway St NE, Ste 225 #280,

Minneapolis, MN 55413